Welcome to Credit Pal Do It Your Self!

Are you tired of dealing with the consequences of a less-than-perfect credit score? Is it hindering your ability to get approved for loans, rent a home, or qualify for better interest rates? You're not alone. Many people struggle with credit issues, but the good news is that you have the power to take control of your credit and improve your financial future with our DIY credit repair tips.

More than a 100 members have joined

DO IT YOURSELF

Remove Charge-Off Accounts, Collection Accounts, Late Payments, Foreclosures, Repos and all other negative items. This will save you thousands of dollars and hundreds of hours of time!

EASY TO USE

All this program takes is the ability to mail a certified letter to the credit reporting agencies. The ebook has step-by-step instructions on what to do, how to do it, and when to it. Everything is included in this kit.

DISPUTE LETTERS INCLUDED

Letter 1: THE INITUAL DISPUTE Letter 2: FOLLOW-UP REQUEST Letter 3: LEGAL DEMAND Letter 4: INTENT TO LITIGATE

NO SECURE CREDIT CARDS

A lot of plans out there will tell you to get a secure credit card and use the secure credit card to rebuild your credit. That means you have to give a creditor cash for them to give you a line of credit

Personal account

Nullam ultricies tristique eros mi arcu blandit leo tortor faucibus maximus. Felis curabitur proin conubia mi quam. Dis leo dolor tincidunt faucibus aptent parturient purus phasellus quam.

Business account

Nullam ultricies tristique eros mi arcu blandit leo tortor faucibus maximus. Felis curabitur proin conubia mi quam. Dis leo dolor tincidunt faucibus aptent parturient purus phasellus quam.

About Credit pal diy

Why Choose Credit Pal DIY for your Credit Repair?

Credit repair can seem like a daunting task, and you may be tempted to hire a credit repair company to do the work for you. However, with a little knowledge and effort, you can repair your credit yourself and save money in the process. Here are some reasons why choosing a DIY approach can be beneficial:

- 1. Cost-effective: Hiring a credit repair company can be expensive, with monthly fees that can add up over time. With our DIY credit repair tips, you can save money and invest it towards paying off your debts or building your savings.

- 2. Empowering: Taking control of your own credit repair journey can be empowering. You'll learn valuable skills and gain knowledge about how credit works, which can help you maintain healthy credit habits in the long run.

- 3. Customized: DIY credit repair allows you to tailor your approach to your specific credit situation. You can focus on the areas that need the most attention and create a personalized plan that fits your needs and goals.

- 4. Transparency: DIY credit repair puts you in charge of the process, giving you full visibility into what's happening with your credit. You can track your progress, review dispute results, and ensure that any changes made to your credit report are accurate and legitimate.

Why choose us

New Credit Pal DIY Package!

GET ABOVE MATERIALS & MORE!

You will get 24-hour access to our DIY repair kit. Which includes a walkthrough from start to finish. With all our tips and trick to this game with call credit. And much more

Learn all the tricks the pros know

We teach you how the pros do this. All the tricks to the trade. Authorize user, Fraud report, police report, freezing personal data, third party agencies, CFPB (Consumer Financial Protection Bureau, etc…

SHORTCUT YOUR TIME

Late payments can have a significant impact on your credit score. Make sure to pay all your bills on time, including credit card payments, loan payments, and utility bills. Set up automatic payments or reminders to avoid missing due dates.

LEARN MORE SECRETS

There is only one Bureau, the Consumer Financial Protection Bureau. Transunion, Equifax and Experian are reporting agencies, they collect and maintain credit information on individuals and businesses, which is then used by lenders, creditors, and other organizations to evaluate creditworthiness and make decisions about loans, credit cards, and other financial products. The CFPB is the only official bureau and the “daddy” of all reporting agencies

Providing the tools needed

Dispute letters, good will letters, the right cards to apply to, knowledge, timing, walkthrough, reports, etc…

A simple system

We walk hand in hand with you through the process. Simplifying the fires of credit repair, with easy-to-follow instructions. With an up-to-date FAQ and as always available through our email. Hundreds have already used our methods. Powered BY “Credit Repair Champ”

DIY Credit Repair Tips:

1. Review Your Credit Reports:

The first step in repairing your credit is to obtain copies of your credit reports from all three major credit bureaus – Equifax, Experian, and TransUnion. Review them carefully for any errors, such as inaccurate personal information, incorrect account details, or fraudulent accounts.

2. Dispute Errors:

If you find any errors on your credit reports, you have the right to dispute them. Follow the credit bureau’s dispute process to challenge any inaccurate information. Provide supporting documentation and keep copies of all correspondence for your records. The credit bureaus have 30 days to investigate and respond to your dispute.

3. Pay on Time:

Late payments can have a significant impact on your credit score. Make sure to pay all your bills on time, including credit card payments, loan payments, and utility bills. Set up automatic payments or reminders to avoid missing due dates.

4.Reduce Credit Card Balances:

High credit card balances can negatively affect your credit utilization ratio, which is the percentage of available credit that you’re using. Aim to keep your credit card balances below 30% of your credit limit to improve your credit score.

5. Negotiate with Creditors:

If you’re struggling with debts, try negotiating with your creditors to work out a payment plan or settle for a lower amount. Many creditors are willing to work with you if you’re proactive and communicate openly about your financial situation.

6. Build Positive Credit:

Building a positive credit history is crucial for credit repair. Consider opening a secured credit card, becoming an authorized user on someone else’s credit card, or taking out a small personal loan to establish positive credit behavior.

7. Be Patient and Persistent:

Credit repair takes time, and it’s essential to be patient and persistent. Keep following up on your disputes, make timely payments, and practice responsible credit habits consistently. Celebrate your progress, and stay committed to your credit repair goals.

Conclusion

Repairing your credit is a journey that requires effort, commitment, and knowledge. With our DIY credit repair program, you have the tools it take to fight the good fight. (USMC Vet)

WE ARE A VETERAN OWNED & OPERATED BUSINESS

Why choose us

NEW BEYOND COMMITTED PACKAGE BELOW!

GET ABOVE MATERIALS & MORE!

You will still get the Section 609 Credit Repair kit plus the Section 609 video series,and travel hacking video series with my travel hacking ebook and How to Sue and Win ebook– $100 Value. And much more!

STUDENT LOAN DISCHARGE FREE

With your purchase I will give you 2 free ebooks (with letters in the ebook) on how to discharge your student loans forever! 2 ebooks and letters this is a $100 value!

SHORTCUT YOUR TIME

I’m going to personally walk you through the entire process from pulling your credit report to sending the certified letters and everything in between. Easily saving you hours! Do the process with zero errors or concerns! Show you my tip for filling out disputes FASTER!

LEARN MORE SECRETS

HOW TO REMOVE TAX LIENS. How to get true FICO’s and not those FAKO’S. Get free and deeply discounted credit reports right from the credit bureaus, how to get a free Fico Estimate, and much more!

UNLIKE ANYTHING ELSE

There isn’t another video series out there that will help you repair your credit. This is the only place to get a true walk-through of the section 609 secret.

VISUAL LEARNING

65% of people are visual learners. This is going to make things so much easier, faster, and way more FUN for you. Bottom line: this system is cool.

Ebook w/ Letters

Sub Heading

$

9

Monthly

-

The Easy Section 609 Ebook

-

Dispute Letters

-

Example Dispute

Ebook w/ Letters

Sub Heading

$

19

Monthly

-

The Easy Section 609 Ebook

-

Dispute Letters

-

Example Dispute

Popular

Ebook w/ Letters

Sub Heading

$

29

Monthly

-

The Easy Section 609 Ebook

-

Dispute Letters

-

Example Dispute

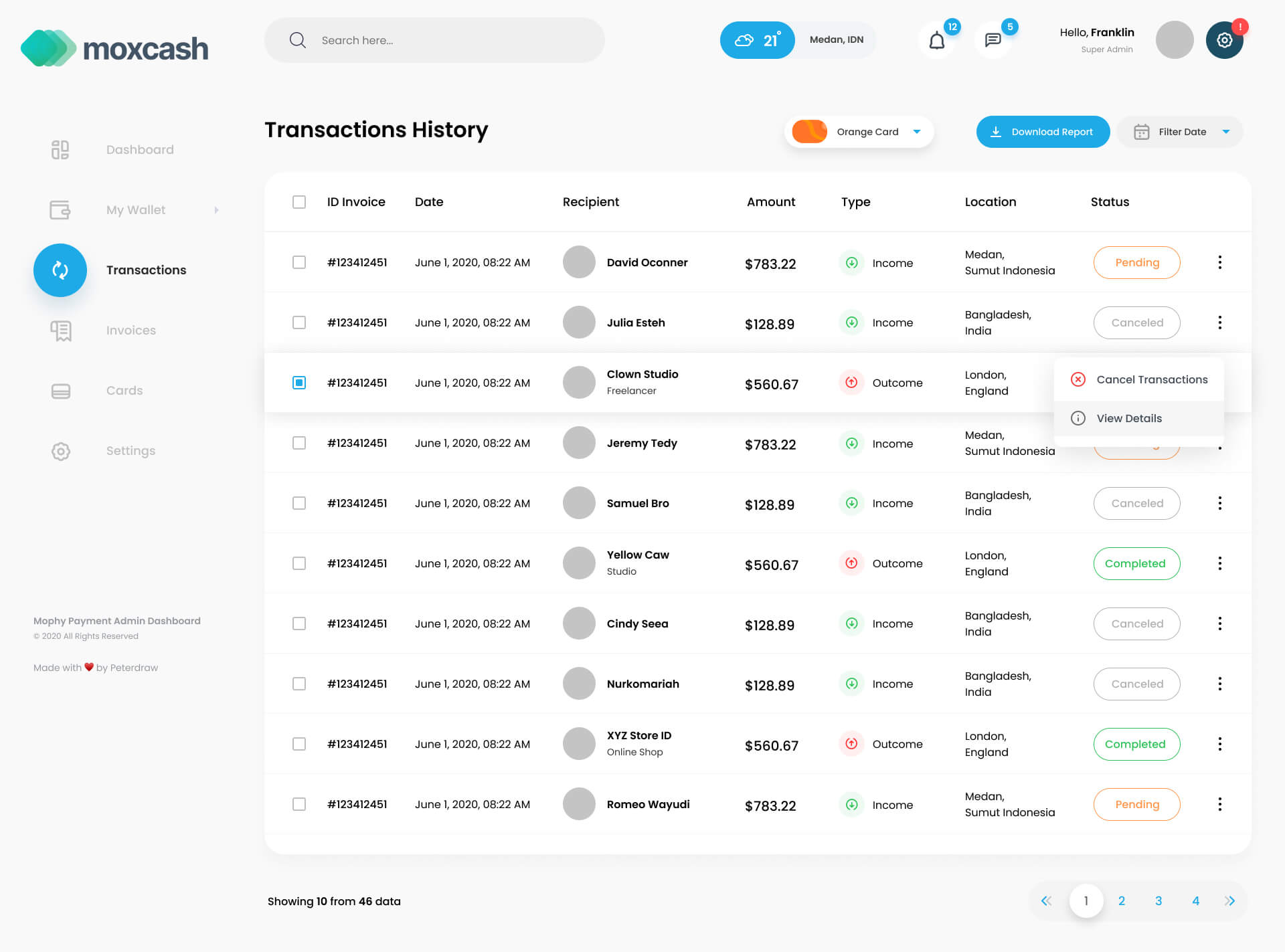

Dashboard

Interactive Dashboard Control Page.

Tortor praesent dictumst aenean consectetuer commodo nibh scelerisque libero rutrum. Per leo diam ligula elit fermentum amet ante vel pharetra mi senectus. Mollis nostra tempor etiam urna facilisis.

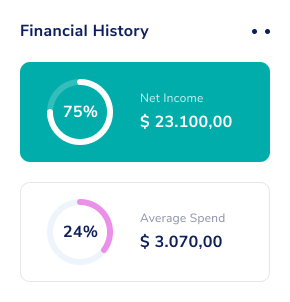

Mobile Platform

Integrate your shopping cart in a matter of minutes.

Tortor praesent dictumst aenean consectetuer commodo nibh scelerisque libero rutrum. Per leo diam ligula elit fermentum amet ante vel pharetra mi senectus. Mollis nostra tempor etiam urna facilisis.

Need more help?

If you are looking for more one on one help. Feel free to reach out to our parent company Credit Repair Champ. Where we can do all the work for you.

Learn To Leverage Your Credit

Leveraging your credit can be a useful tool to help you achieve your financial goals, such as building credit, getting approved for loans, and earning rewards.

No Secure Credit Cards

A lot of plans out there will tell you to get a secure credit card and use the secure credit card to rebuild your credit. That means you have to give a creditor cash for them to give you a line of credit. It is much cheaper to fix your credit with the Section 609 Credit Repair Secret then to pay a credit card company cash for a line of credit.

Our easy-to-follow DIY will put you back on track

We have written out all our steps from start to finish. This program was designed by our parent company “Credit Repair Champ”. Which have helped 100’s of clients with their credit goals

Testimonial

Hear what some of our clients are saying about us.

On January 25th, 2016, I sent my initial letter to all three credit bureaus. As of today, January 11th, 2016, I have received correspondence from Transunion informing me that all four of the accounts I disputed have been removed. As a result, my credit score has increased by 81 points.

As I was searching for ways to improve my credit score, I came across Brandon Weaver's YouTube page. After listening to his story, I decided to purchase his eBook, and I'm so glad I did! His information has been incredibly helpful, and it saved me $2,000 that I would have otherwise spent on expensive credit companies. Thanks to his system, I have been able to achieve the same, if not better, results than those expensive credit repair companies.

As someone who has worked in collections for a decade, I can attest to the accuracy of everything that has been stated. Don't let letters and phone calls intimidate you! Once an account has been removed from your credit report, it can no longer negatively affect you. By taking the time to delete inquiries and fix an address error, I was able to increase my credit score by 204 points. It's important to know your rights and not let debt collectors push you around.